Business Insurance in and around Dubuque

Get your Dubuque business covered, right here!

Insure your business, intentionally

This Coverage Is Worth It.

Preparation is key for when something unavoidable happens on your business's property like an employee getting injured.

Get your Dubuque business covered, right here!

Insure your business, intentionally

Customizable Coverage For Your Business

Planning is essential for every business. Since even your most detailed plans can't predict consumer demand or natural disasters. In business, you can be certain of one thing: nothing is certain. That’s why it makes good sense to plan for the unexpected with a State Farm small business policy. Business insurance is necessary for many reasons. It protects your future with coverage like extra liability and worker's compensation for your employees. Fantastic coverage like this is why Dubuque business owners choose State Farm insurance. State Farm agent Rachel Davis can help design a policy for the level of coverage you have in mind. If troubles find you, Rachel Davis can be there to help you file your claim and help your business life go right again.

Eager to discover the specific options that may be right for you and your small business? Simply contact State Farm agent Rachel Davis today!

Simple Insights®

How to do small business inventory

How to do small business inventory

Learn more about small business inventory, including types, tracking tools and strategies to help your business succeed.

Money management strategies for the self-employed

Money management strategies for the self-employed

Working for yourself and managing money can be challenging. Create money management strategies to help your business thrive.

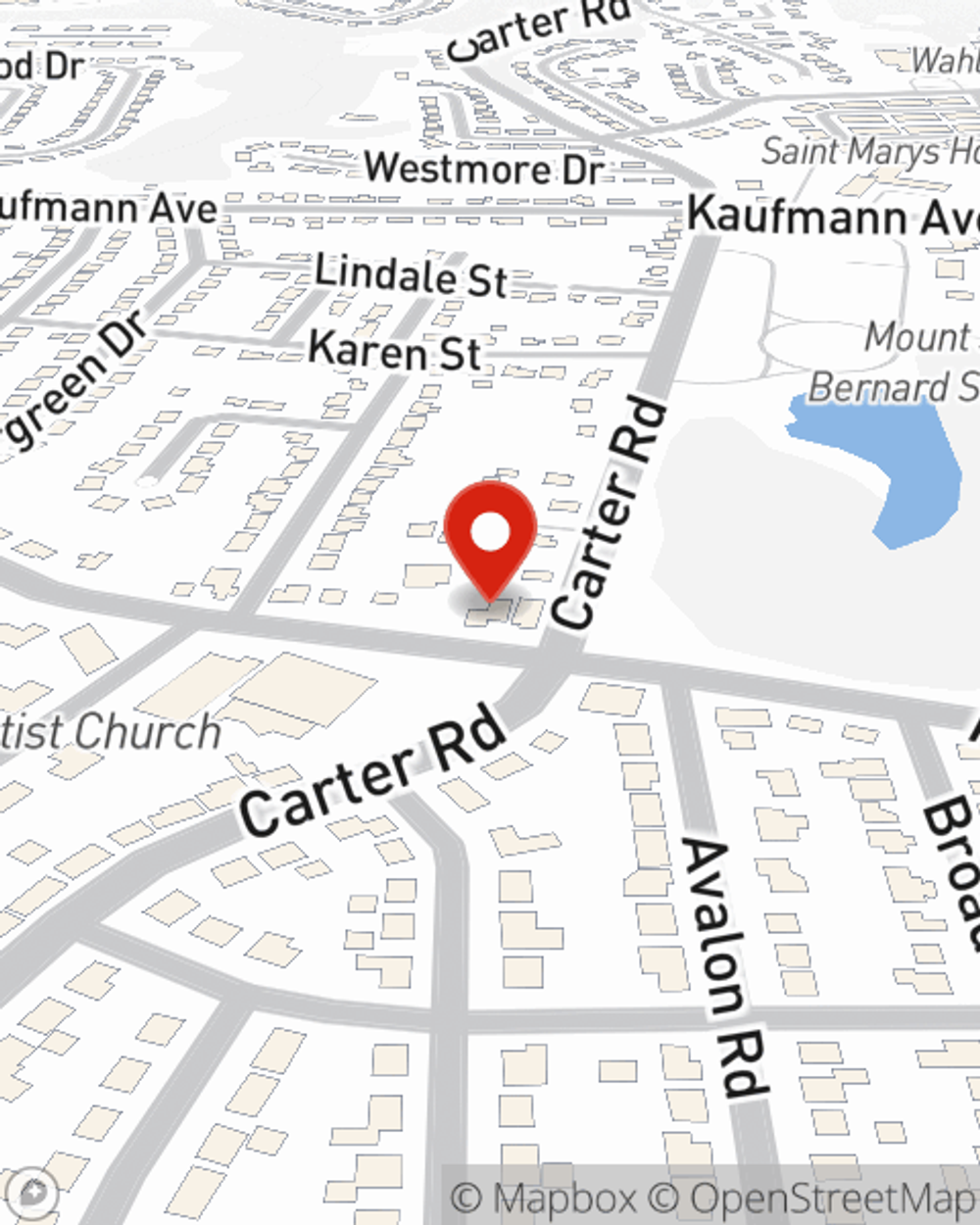

Rachel Davis

State Farm® Insurance AgentSimple Insights®

How to do small business inventory

How to do small business inventory

Learn more about small business inventory, including types, tracking tools and strategies to help your business succeed.

Money management strategies for the self-employed

Money management strategies for the self-employed

Working for yourself and managing money can be challenging. Create money management strategies to help your business thrive.